Understanding Precious Metals

Precious metals include gold, silver, platinum, and palladium. These metals have intrinsic value due to their rarity and are often used in jewelry, electronics, and as investment vehicles. Gold has been a store of value for centuries, often perceived as a safe haven during economic uncertainty. Silver, while less expensive, plays a critical role in industrial applications, particularly in electronics and solar energy.

Types of Precious Metal Investments

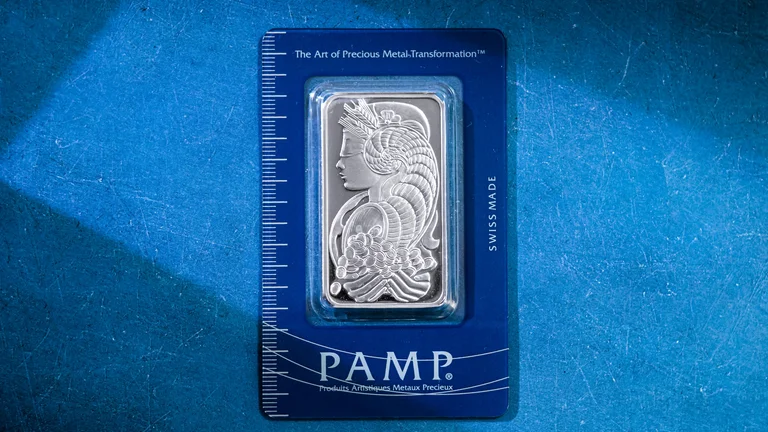

Investors have multiple options when it comes to investing in precious metals. Physical bullion, including coins and bars, offers direct ownership. ETFs (exchange-traded funds) provide exposure to precious metals without the need to store them physically. Mining stocks allow investors to gain leverage through companies engaged in extracting these metals. Each investment type comes with distinct risk and reward profiles.

Market Factors Influencing Precious Metals

Several factors influence the price and demand for precious metals. Economic indicators, currency fluctuations, and geopolitical events can cause volatility in the market. The stronger the economy, the less investors tend to flock to precious metals. Conversely, during periods of inflation or crisis, demand often rises. Understanding these dynamics is crucial for investors interested in timing their market entries.

Benefits of Investing in Precious Metals

Investing in precious metals offers diversification. Unlike stocks or bonds, precious metals have historically retained value over time. They can provide a hedge against inflation and economic downturns. Additionally, some metals carry industrial demand, which can boost their value beyond just investment appeal. Their physical form also offers a sense of security that some investors prefer.

Risks Involved in Precious Metal Investments

No investment is without risks, and precious metals are no exception. Price volatility can lead to rapid losses. The costs of storage and insurance for physical bullion can also add up. Moreover, market dynamics can shift unpredictably, leaving investors vulnerable to downturns. It's essential to conduct thorough research and consider one’s financial goals before venturing into this market.

| Metal | Current Price (per oz) | Investment Type | Key Factors | Investment Risks |

|---|---|---|---|---|

| Gold | $1,800 | Physical, ETFs, Mining Stocks | Inflation, Market Stability | Volatility, Storage Costs |

| Silver | $25 | Physical, ETFs, Mining Stocks | Industrial Demand, Economic Health | Price Fluctuations, Market Dynamics |

| Platinum | $1,100 | Physical, ETFs, Mining Stocks | Automotive Demand, Economic Recovery | Lower Demand, Market Shifts |

| Palladium | $2,200 | Physical, ETFs, Mining Stocks | Automotive Demand, Geopolitical Tensions | Price Volatility, Supply Chain Issues |

FAQ - Investing in Precious Metals

What are the main types of precious metals?

The primary types of precious metals are gold, silver, platinum, and palladium.

Why invest in precious metals?

Investing in precious metals can provide diversification, act as a hedge against inflation, and retain value during economic downturns.

How can I invest in precious metals?

You can invest in precious metals by purchasing physical bullion, buying ETFs, or investing in mining stocks.

What factors affect the prices of precious metals?

Prices are influenced by economic indicators, currency fluctuations, and geopolitical events.

Are there risks in investing in precious metals?

Yes, risks include price volatility, storage costs, and market dynamics.

Investing in precious metals involves purchasing gold, silver, platinum, or palladium to diversify portfolios and hedge against inflation. These investments can be made through physical bullion, ETFs, or mining stocks. Understanding market factors and risks is essential for successful investment in precious metals.

Conclusão sobre Investing in Precious Metals.